Farming is more than a business — it’s a way of life. When you shoulder the soil, nurture crops, raise livestock, and maintain equipment, day in and day out, you’re investing not just time and labor but your very legacy. The right protection matters. That’s where farm insurance comes in — tailored coverage that safeguards your operations from the risks no one can anticipate.

At Hanford Insurance, we don’t just write policies. We partner with you to design coverage that reflects your land, climate, crops, livestock, and long-term goals.

What Is Farm Insurance — and Who Needs It?

Farm insurance (sometimes called “farmowners” or “farm package” insurance) is a blended policy designed for agricultural operations. It typically combines:

- Coverage for farm buildings and structures (barns, silos, sheds, equipment storage)

- Coverage for the farm dwelling (if you live on the land)

- Equipment, tools, and machinery protection (tractors, combines, irrigation systems, hand tools)

- Livestock insurance (loss, theft, disease)

- Crop insurance (depending on region, versus perils like drought, hail, flooding)

- Liability coverage (bodily injury, premises liability, product liability)

- Business interruption / loss of income protection (if disaster disrupts operations)

If you own a farm — small or large — with structures, equipment, livestock, or crops, farm insurance is essential. Even a modest operation can suffer catastrophic losses from fire, windstorm, theft, or liability claims.

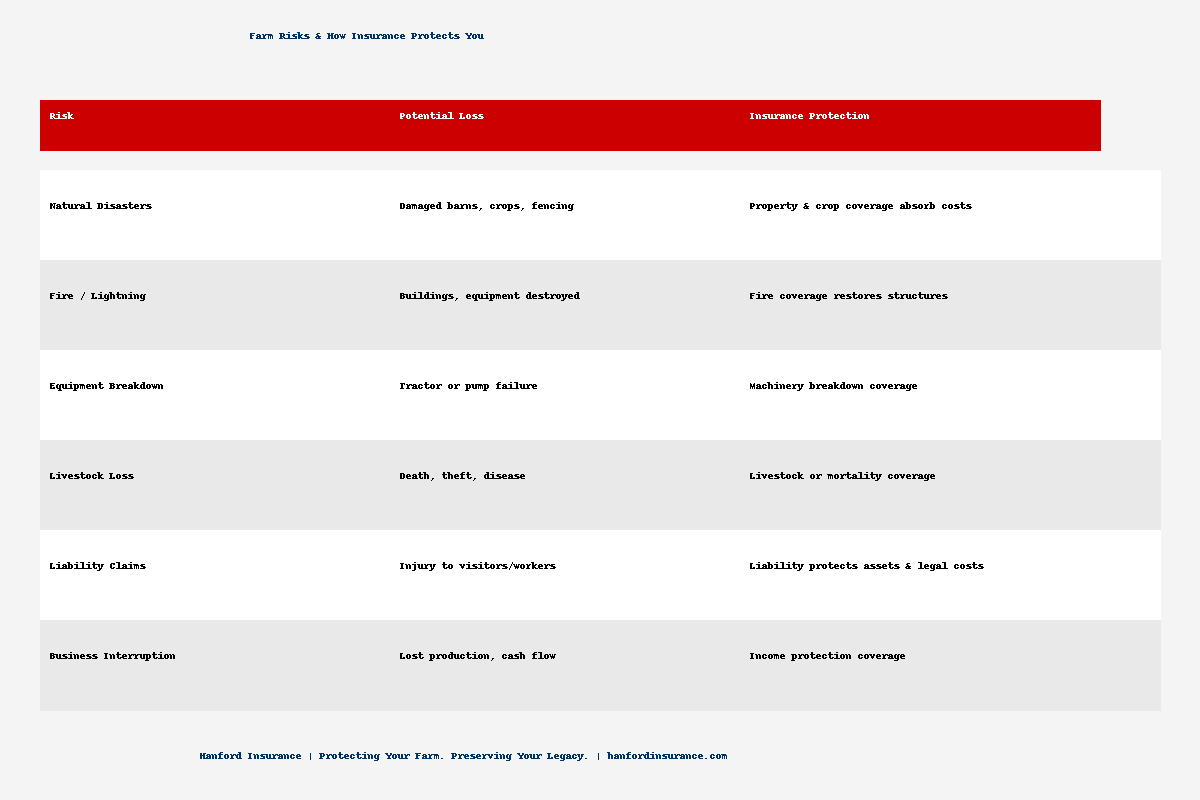

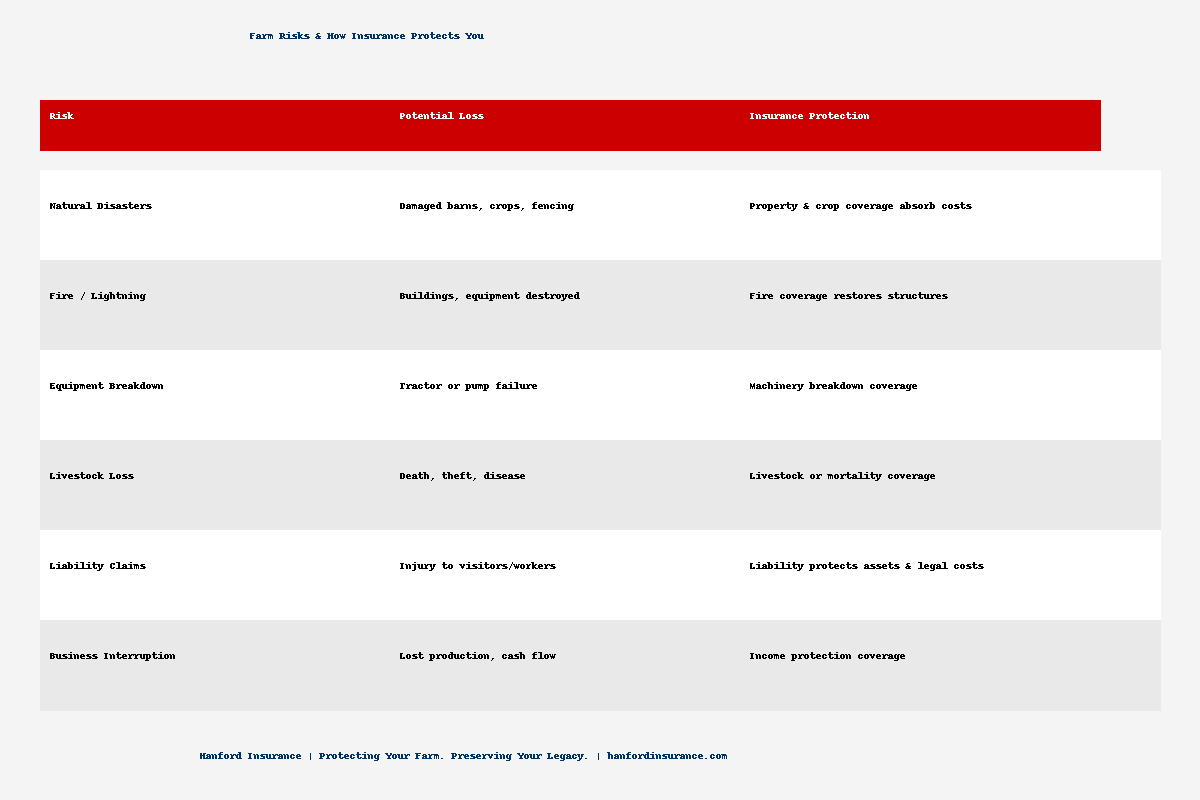

Key Risks That Farm Insurance Addresses

Let’s break down what “risks” really mean in farm life — and why each deserves coverage:

These risks can hit even the most prepared farmers, which is why having a comprehensive, well-tailored policy is so important.

What Makes a Great Farm Insurance Policy?

To get real value, your farm insurance policy should offer more than a “one size fits all” approach. Here’s what to look for — and how Hanford helps deliver:

1. Customization Based on Your Operation

No two farms are identical. Whether you’re a row-crop producer in Illinois, run a dairy, raise beef cattle, grow specialty vegetables, or have greenhouses — your coverage must reflect your specifics.

Hanford’s agents dig into your property maps, equipment lists, livestock counts, and crop plans to craft a policy that fits your risk profile.

2. Adequate Limits and Replacement Cost Provisions

Insuring for “just enough” isn’t protection — it’s exposure. Make sure your building and equipment limits represent replacement costs, not depreciated values. Ask about inflation guard clauses, which help ensure coverage keeps up with rising material and labor costs.

3. Optional Endorsements / Add-Ons

Some coverage features may not be standard, but they could be critical for you:

- Machinery breakdown / mechanical failure

- Livestock mortality / disease coverage

- Equipment floater (off-premises gear)

- Irrigation / pump and well coverage

- Pollution or chemical liability

- Crop/hail insurance (where available)

- Umbrella liability or excess policies

An agent should help you identify which endorsements are worth the extra premium for your situation.

4. Strong Liability and Legal Protection

Farms can be legally complex — liability exposures abound when visitors, customers, or contract workers access your property. Make sure your policy includes:

- Personal liability

- Property liability

- Products/completed operations (if you sell produce or goods)

- Legal defense costs

5. Claims Service & Local Knowledge

You don’t just want coverage — you want a partner when disaster strikes. Because Hanford is independent and community-rooted, our agents are committed to:

- Prompt claim assistance

- Transparent communication

- Understanding local farming conditions, weather patterns, and regulatory environments

We work to ensure you’re not stranded when you need help most.

Five Farm Insurance Tips for Smarter Coverage

- Inventory Everything

Maintain a detailed, up-to-date list (with photos, serial numbers) of equipment, tools, machinery, and livestock. That makes claims smoother and valuations fair.

- Review and Update Annually

Farms evolve — you buy new equipment, expand, diversify. Revisit your coverage yearly with your agent.

- Mitigate Risk Proactively

Install fire alarms, lightning rods, security systems, fencing, drainage controls. Insurers reward reduced risk.

- Know Your Deductibles and Perils

Understand what perils are covered (e.g. flood, wind, hail) and how deductibles apply (percentage vs fixed).

- Bundle When Possible

Combine farm, home, auto, liability under one insurer or through an agent to potentially reduce costs and simplify servicing.

Why Hanford Insurance for Farm Coverage?

- Experience Since 1855 — We’ve served communities for over a century and a half, building trust and deep expertise.

- Independent Agency — We’re not locked into a single carrier. We shop rates across multiple insurers to find you the best coverage at the best value.

- Local Insight — We know Illinois (and surrounding region) weather patterns, state regulations, and agricultural norms.

- Dedicated Claims Support — When you file a claim, our agents stand with you from start to finish.

- Customized Solutions — No cookie-cutter approach. Your farm is unique — your coverage should be too.

What’s Next?

If you’re a farmer — or considering expanding operations — don’t delay assessing your risks. Even small gaps in coverage can become massive financial burdens in the wake of disaster.

Here’s what you can do now:

- Contact Hanford Insurance — Request a farm insurance review.

- Gather Your Details — Prepare property maps, equipment lists, livestock counts, and historical loss info.

- Schedule a Coverage Audit — Sit down with an agent to align your operations and exposures with optimal policy design.

- Stay Engaged & Update — Review your insurance annually or whenever significant changes (new buildings, equipment, agricultural programs) happen.

Protecting your farm is about more than safeguarding assets — it’s about preserving your heritage, livelihood, and peace of mind. At Hanford Insurance, we’re ready to walk beside you in that mission.

Let’s talk — let us help you grow with confidence, knowing your farm is secured.