Standard farm insurance in Illinois typically covers:

Damage to farm buildings—barns, silos, sheds, and your farmhouse—from perils like storms or fire.

Protection for farm equipment and machinery, such as tractors, combines, hay rakes, plus tools and even contents of buildings.

Liability coverage for accidents or lawsuits—important if a visitor gets injured on your property.

For farms, fall is often a peak period when inventory—like harvested grain or livestock—is at its highest. Peak Season Coverage is an optional add-on that provides:

Temporary boost in coverage limits during busy times such as harvest or calving.

Customizable start and end dates, so you’re not paying year-round for heightened limits.

Coverage for inventory, livestock, or stored crops under the same risks as your standard policy.

Why it’s a smart move this time of year:

Harvest season is imminent. Asset values are up. Protect your investments when they’re most vulnerable.

Flexible and cost-effective—adds protection only when you need it.

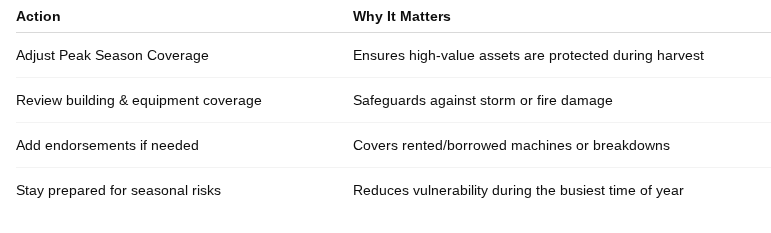

Since it’s late August heading into early fall:

Assess when your harvest begins and ends. Plan Peak Season Coverage to align with these key dates.

**Review your current policy—**ensure your buildings, equipment, and stored products are properly insured.

Consider seasonal risks:

Storms may threaten equipment or standing crops.

Cooler, moist nights can increase storage risks like mold.

Cooler weather may strain livestock; ensure coverage includes barn contents and livestock if applicable.

Plan for compounding needs: If you’re renting or borrowing extra machinery, you might want additional endorsements like Equipment Breakdown or Borrowed Equipment Coverage.

Bottom line—as Geneseo farmers head into harvest season, it’s a critical window to make sure your insurance keeps pace with changing risks and values.

Here’s a quick farming-season checklist: